In a recent press release from the Federal Open Market Committee, the tone is cautiously optimistic. Littered throughout the release is the word, “however.” Things are good, but other things are bad. Also, some factors are positive, yet be mindful: Others are negative.

Maybe it’s more accurate to say the tone was carefully moderated hopefulness. Or maybe conservative pessimism is better?

Before I get lost in the semantics, it’s worthwhile to note the following: “Household spending has been increasing at a moderate rate, and the housing sector has improved further; however, business fixed investment and net exports have been soft.” Moreover, job gains have been strong, the labor market has witnessed a degree of strengthening, and inflation has been rising.

But the Fed points out that inflation levels are still hovering underneath their objective for the long-term, which is 2 percent. This is partially a result of the decline in energy prices, as well as the prices of non-energy imports.

For those with the work ethic or knowledge to decipher the academic jargon contained within the release, the message was clear. The Fed believes that recent analyses of economic data show that everything is basically alright, but there are storm clouds on the horizon. One of the main reasons the Fed thinks there could be trouble in paradise is the worry about “global economic and financial developments,” also known as the drop in oil prices and the effect that has had on micro- and macro-economies.

Simply put, corporations and countries affected by the price of oil have had some of their toughest years in recent memory. This is making the Fed a little gun-shy about increasing interest rates in the short term.

Considering that the Fed is forced to walk a tightrope when it comes to its communications, it’s easy to see why it could be viewed as non-committal. Approach the negative too closely, and markets react negatively. Stray too close to the positive and people will ask why rates were not increased.

The Fed’s conclusions support this point, since it expects that “economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However,” (there’s that word again) the actual path of interest rates will depend on economic data made available to us moving forward.

Thus, the Fed leaders move away from the point they made in the previous sentence, making everyone aware they will adjust their fighting stance to match the condition of the economy as it changes. In essence, Fed leaders are letting everyone know they will do their job.

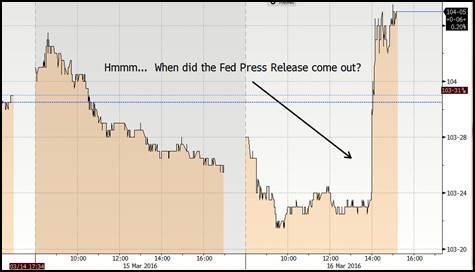

The takeaway is that the Fed is deciding to keep short-term interest rates low. The chart below shows that bond traders were happy with the Fed’s decision, so they bought bonds and prices went up. When bond prices increase, interest rates go down, and this is a cause for celebration for anyone who might be shopping for a home.

For a free consultation about what this means for your purchasing power, contact me at the number below.

Patrick Stoy (NMLS Numbers 39527 and 39166) has 16 years of mortgage lending experience. Patrick is CEO of Wilmington-based Market Consulting Mortgage, which he started in 2005 with a mission to build lifelong customer relationships by providing real value. To learn more about Marketing Consulting Mortgage, visit www.macmtg.com. Patrick can be reached at [email protected] or (910) 509-7105.

YMCA Eyes Growth With Plans For New, Expanded Facilities

Emma Dill

-

Apr 23, 2024

|

|

Burns, Redenbaugh Promoted At Coastal Horizons

Staff Reports

-

Apr 23, 2024

|

|

Cold Storage Developer Sets Near-port Facility Completion Date

Audrey Elsberry

-

Apr 24, 2024

|

|

Wilmington Financial Firm Transitions To Wells Fargo's Independent Brokerage Arm

Audrey Elsberry

-

Apr 24, 2024

|

|

Krug Joins Infinity Acupuncture

Staff Reports

-

Apr 23, 2024

|

|

Lydia Thomas, program manager for the Center for Innovation and Entrepreneurship at UNCW, shares her top info and tech picks....

“My mission and my goal is to take my love of marine science, marine ecosystem and coastal ecosystems and bring that to students and teacher...

With millions in committed funding from New Hanover County and the New Hanover Community Endowment, along with a land donation from the city...

The 2024 WilmingtonBiz: Book on Business is an annual publication showcasing the Wilmington region as a center of business.