Being able to identify a problem is one thing. Being able to do something about it is a completely different issue. As business leaders, we use a variety of tools and data to help us affect change that will improve our organizations’ productivity or profitability. On rare occasions, we find line items that can address both. At Wilmington Health, we have found by working with employers to address elements of their companies’ health insurance plans, we can do both simultaneously.

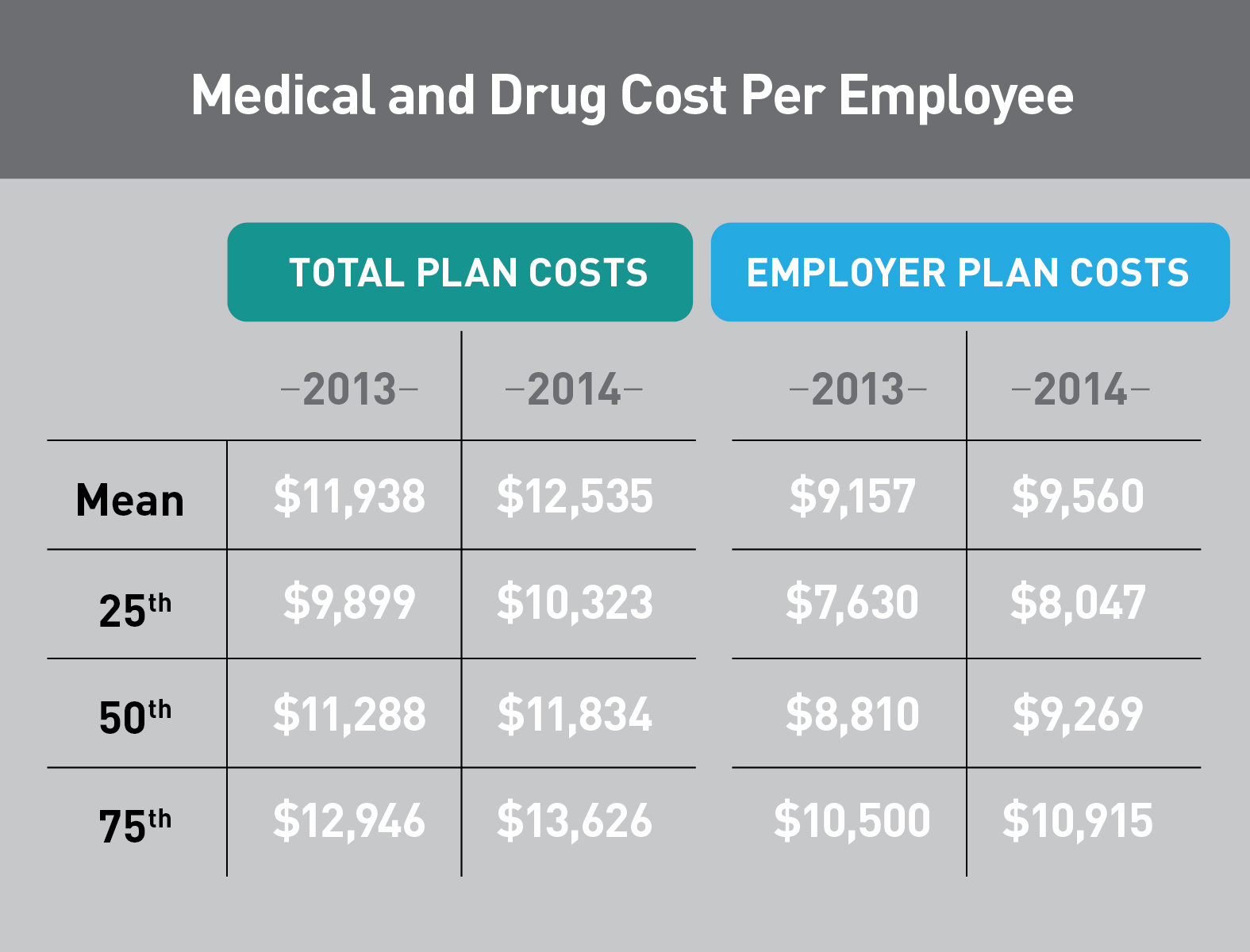

First, let’s identify where your plan ranks among other employer-backed health plans across the nation. Based on data from the 19th Annual Towers Watson National Business Group on Health Employer Survey on Purchasing Value in Health Care, the average (or mean) employer saw a $400, or 4.4 percent, cost increase per employee from 2013 to 2014.

If you look at total plan costs on this same chart, you’ll see an increase of nearly $600, meaning that employees also saw a $200 increase in their health care plan costs (calculated by subtracting the difference between the employer plan cost increase and the total plan cost increase.) In effect, employers are picking up two-thirds of the overall plan cost increase on a year-over-year basis. So clearly this issue needs to be addressed by employers.

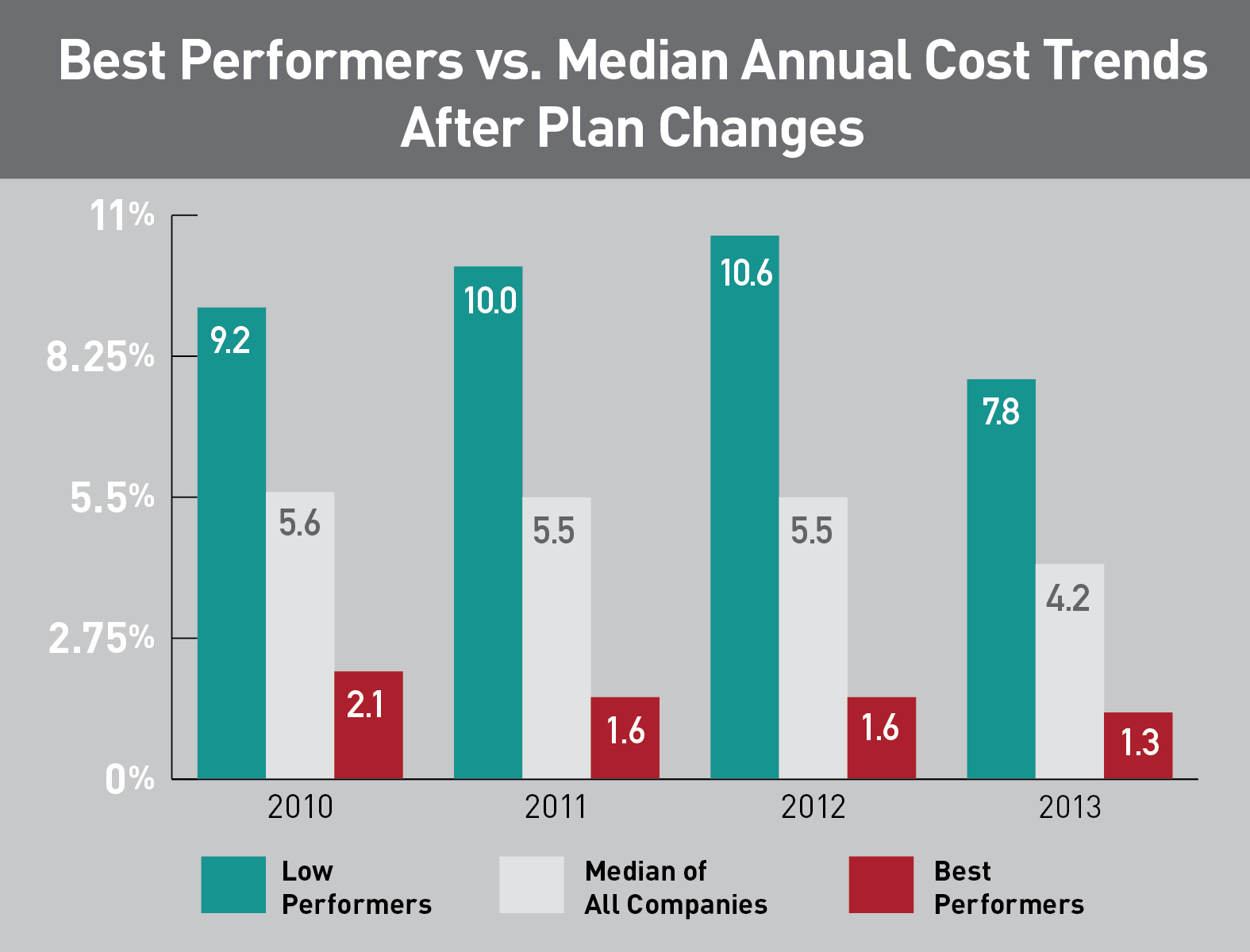

Also, based on the same survey and data, some employers are taking the challenge of reducing health care costs head on. For those employers who decided to make changes to their health care plans, there is a definite trend that they are obtaining better control of their health plan costs. By taking charge of their health care plans, regardless of whether they were a “low-performing” or “high-performing” plan, companies saw a median cost reduction of 1.5 percent in only four years.

That is a major turnaround for a line-item expense that often sees double digit increases every year.

So how did those companies achieve these results and affect real change on their health insurance premium expenses? Well, they take a systematic approach that requires looking at multiple aspects of their plans and how they support their employees’ abilities to achieve better health and remain there. We’ve seen the opportunity to affect real change fall into four major areas:

YMCA Eyes Growth With Plans For New, Expanded Facilities

Emma Dill

-

Apr 23, 2024

|

|

Burns, Redenbaugh Promoted At Coastal Horizons

Staff Reports

-

Apr 23, 2024

|

|

Cold Storage Developer Sets Near-port Facility Completion Date

Audrey Elsberry

-

Apr 24, 2024

|

|

Wilmington Financial Firm Transitions To Wells Fargo's Independent Brokerage Arm

Audrey Elsberry

-

Apr 24, 2024

|

|

Krug Joins Infinity Acupuncture

Staff Reports

-

Apr 23, 2024

|

|

“My mission and my goal is to take my love of marine science, marine ecosystem and coastal ecosystems and bring that to students and teacher...

Baristas are incorporating craft cocktail techniques into show-stopping coffee drinks, and bartenders are mixing espresso and coffee liqueur...

Michelle Penczak, who lives in Pender County, built her own solution with Squared Away, her company that now employs over 400 virtual assist...

The 2024 WilmingtonBiz: Book on Business is an annual publication showcasing the Wilmington region as a center of business.