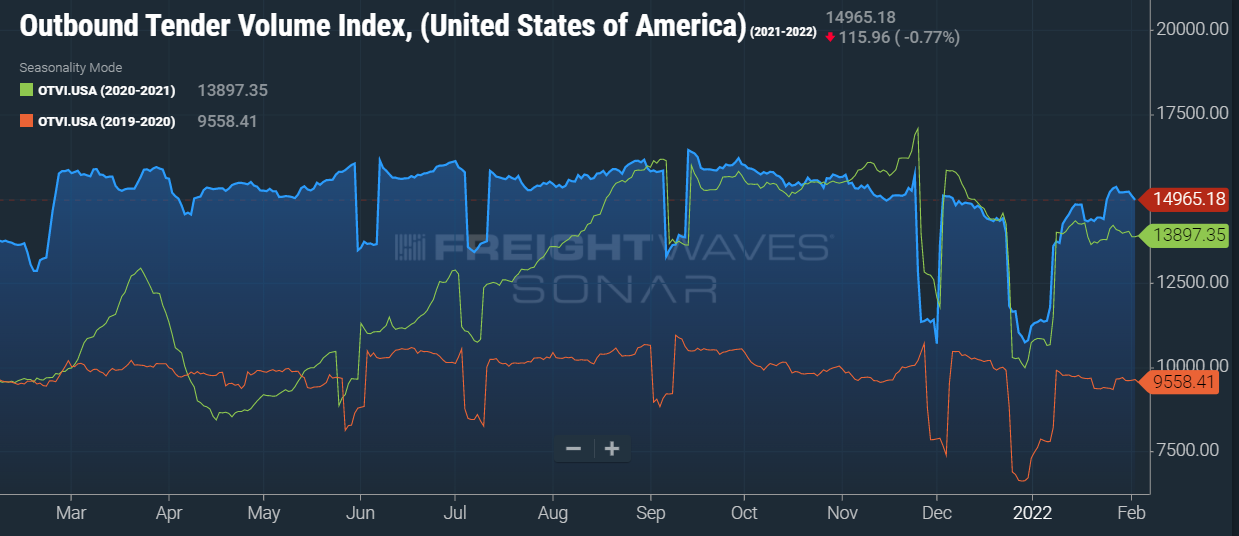

The ongoing "peak-season" continues into 2022 with a 7.7% increase in freight volumes over January and February 2021, and a 56.6% increase over February 2020. Shipping is still so active that the seasonality we were used to has become muted and we remain in one long "peak-season" that has continued for over a year and a half.

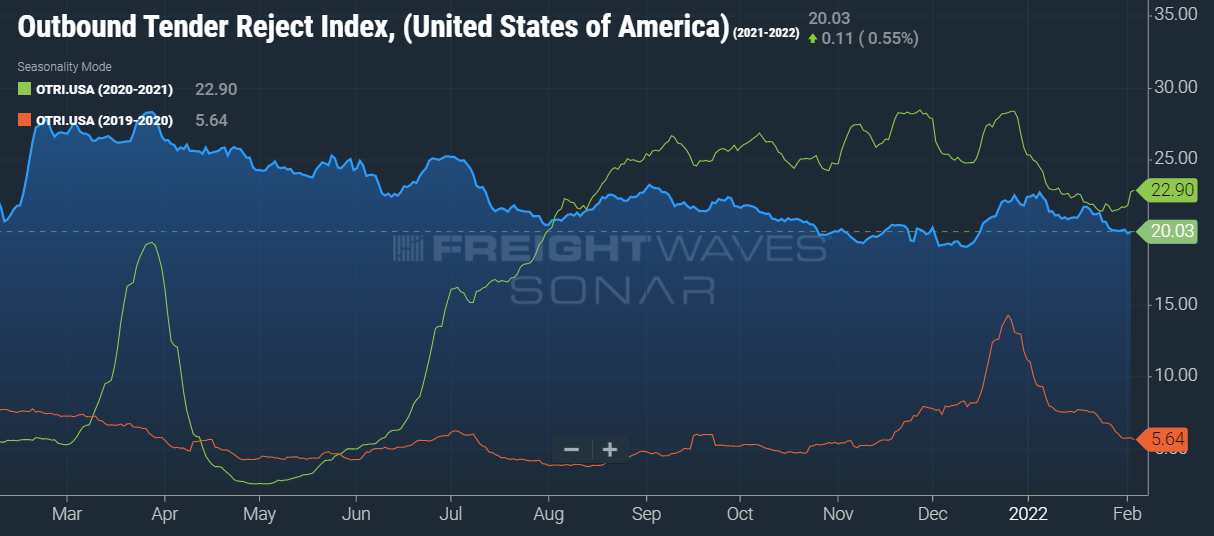

Tender rejection rates are still at 20%, meaning that one in five truckloads that are electronically ready and tendered are not being picked up within 24 hours. Tender rejection rates have been this high for this long mostly due to lack of equipment instead of being rejected by carriers to seek higher-paying loads, which is still a factor but not the number one reason for rejection in today's shipping climate. Orders are still at an all-time high keeping a lot of pressure on capacity.

When Will The Market Loosen Up?

There may be some temporary loosening late this summer, but the consensus from senior executives and economists at a Supply Chain Conference we attended in January aligns with what our internal research team is finding: assuming there is some Covid stability, the market will stay this way for 12-18 months. Severe labor shortages across all sectors of the supply chain are the underlying cause of this volatile market and not one that has a quick fix.

The labor shortage is so extreme due to several factors: more people took an early retirement than ever before in US history; there have been (and still are) Covid labor business restrictions; people have moved on to new jobs in the "Gig Economy"; some are still unable to return to work due to child care and school restrictions; and Covid shut down many trade schools or caused them to operate only at a fraction of their capacity, further slowing the addition of more drivers into the industry. The labor shortage, partnered with an equipment shortage for the trucking industry, make it impossible to keep up with 60% more shipments that there are on the road now than there were pre-pandemic.

The industry is still seeing significant expansion according to the Logistics Managers Index (LMI). January’s Inventory Levels came in at 71.1 – the highest rate of growth since early 2018. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. Not only does this mean continued low capacity and high costs, it also means that there will be considerable, prolonged stress put on the overall supply chain to avoid these shortages.

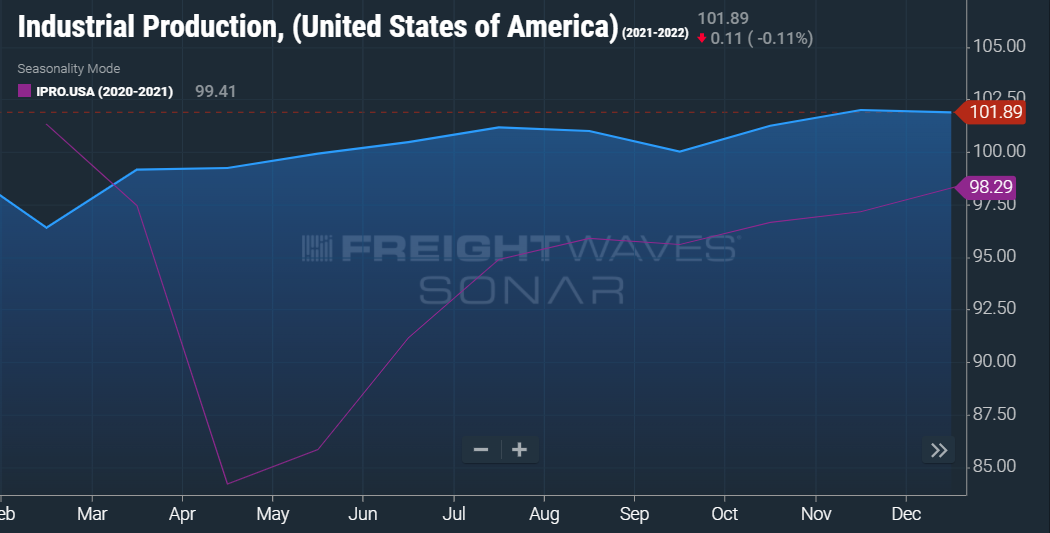

The Industrial Production index chart also shows we are still producing more than this time in 2021. This indicates that warehousing space will be an additional pain point in 2022. Especially when we take into account the backlog at the ports, which has inventory arriving late and out of season (for example, Halloween costumes, holiday decor, seasonal clothing items, etc.) that will need to be stored until next year.

Pricing Trends

To keep up with spot rates, contract rates continue to rise, which will be a trend we will see throughout 2022 as the industry tries to catch up, and as contract rates have to compete with the higher paying spot loads. We still remain in an "inverted market" where spot rates out-perform contract rates, which aids the upward trend in shipping costs. Both contract and spot rates are more than 15% higher than they were a year ago. However, the good news is that the gap is narrower than the 20% year-over-year increases experienced in recent months.

Continued Port Congestion

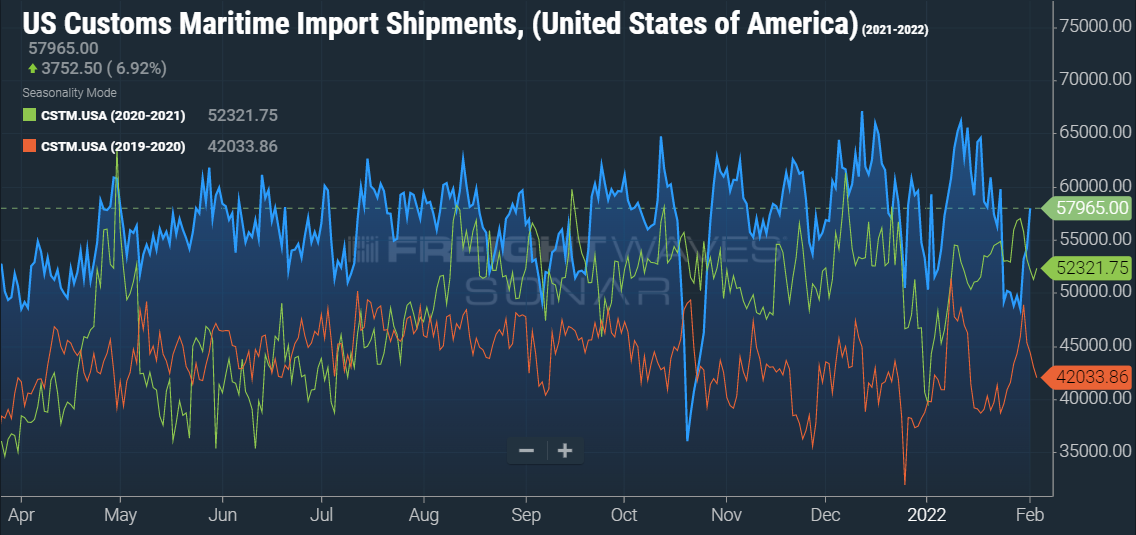

Maritime shipments continue to arrive in abundance. The dip reflected in blue (current 12 months) is due to the Lunar New Year. The TEU index’s forecast shows that we will reach the highest level of volumes since the beginning of the pandemic, which is very concerning due to lack of warehouse space and capacity. This sector of the supply chain isn't expected to see relief until 2023.

As always, MegaCorp is here to help. You can rely on us in any market and trust that we will deliver.

YMCA Eyes Growth With Plans For New, Expanded Facilities

Emma Dill

-

Apr 23, 2024

|

|

Burns, Redenbaugh Promoted At Coastal Horizons

Staff Reports

-

Apr 23, 2024

|

|

Cold Storage Developer Sets Near-port Facility Completion Date

Audrey Elsberry

-

Apr 24, 2024

|

|

Wilmington Financial Firm Transitions To Wells Fargo's Independent Brokerage Arm

Audrey Elsberry

-

Apr 24, 2024

|

|

Krug Joins Infinity Acupuncture

Staff Reports

-

Apr 23, 2024

|

|

With millions in committed funding from New Hanover County and the New Hanover Community Endowment, along with a land donation from the city...

“My mission and my goal is to take my love of marine science, marine ecosystem and coastal ecosystems and bring that to students and teacher...

W.R. Rayson is a family-owned manufacturer and converter of disposable paper products used in the dental, medical laboratory and beauty indu...

The 2024 WilmingtonBiz: Book on Business is an annual publication showcasing the Wilmington region as a center of business.